Finance companies today deal with massive volumes of customer data—applications, transactions, interactions, compliance documents, and service requests. However, having data does not automatically translate into meaningful customer insights. Many finance firms struggle with disconnected systems that limit visibility into customer behavior, risk patterns, and growth opportunities.Finance companies handle vast amounts of customer data, but disconnected systems often limit visibility into customer behavior and risk.

Dynamics 365 CRM helps finance companies turn scattered data into clear, actionable customer insights. By centralizing information and enabling real-time analysis, it allows teams to make smarter decisions, improve customer experience, and stay compliant all from a single platform. Learn how CRM systems drive team efficiency and scalability:

What Are Customer Insights in Finance Companies?

Customer insights in finance refer to actionable intelligence derived from customer data that helps organizations understand behavior, preferences, risks, and future needs. These insights go beyond basic contact information and include engagement history, financial transactions, service interactions, and risk indicators across the customer lifecycle.

For finance companies, customer insights play a critical role in managing high-value decisions, reducing risk, and meeting strict regulatory requirements. When insights are accurate and timely, teams can personalize services, improve risk assessment, and respond proactively to customer needs. Without reliable insights, decisions are often based on assumptions rather than data, leading to inefficiencies, compliance challenges, and missed growth opportunities.

Modern CRM platforms help finance firms transform raw data into meaningful insights by unifying information and enabling real-time analysis.

To understand how secure data handling supports this process, explore Microsoft’s approach to financial data security.

Common Customer Insight Challenges Faced by Finance Companies

Many finance companies struggle to generate reliable customer insights because their data is spread across multiple systems, including ERP platforms, spreadsheets, email tools, and legacy software. This fragmented data environment prevents teams from building a unified customer view, making it difficult to understand customer behavior, financial history, risk exposure, and engagement patterns. As a result, relationship managers, sales teams, and service agents often work with incomplete or inconsistent information, which limits personalization and slows down decision-making across the organization.

Another major challenge is delayed and inaccurate reporting. When customer insights rely on manual data collection and reconciliation, finance companies are forced into reactive decision-making rather than proactive planning. This not only affects operational efficiency but also increases compliance risks, as duplicated or outdated data can lead to reporting errors and audit challenges. Maintaining data accuracy and governance becomes especially complex in regulated environments, where security and compliance are critical. According to Microsoft’s guidance on secure data management, centralized and governed data systems play a key role in improving insight quality and regulatory compliance in financial services

How Dynamics 365 CRM Creates a 360° Customer View

Dynamics 365 CRM creates a single, unified customer view by consolidating all sales, service, and communication data into one centralized record. This eliminates data silos and gives finance teams instant access to accurate, up-to-date customer information.

With complete visibility into customer history, engagement patterns, and current needs, teams can respond faster, personalize interactions, reduce risk, and make confident decisions at every touchpoint. The result is stronger relationships, higher customer trust, and improved business outcomes across the finance lifecycle.

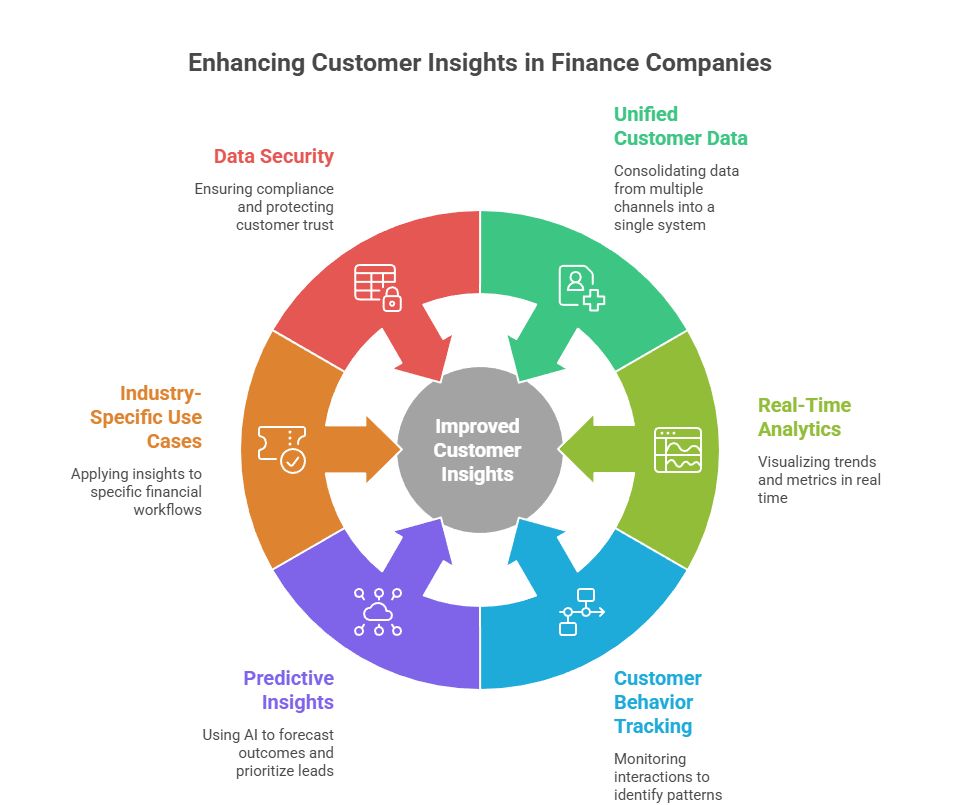

Key Ways Dynamics 365 CRM Improves Customer Insights

Unified Customer Data Across Channels

Dynamics 365 CRM brings together customer data from multiple touchpoints into a single system. Emails, calls, meetings, applications, and service interactions are automatically linked to the customer record. This ensures that insights are based on complete and consistent information, not isolated data points.

Real-Time Analytics and Dashboards

With built-in dashboards and Power BI integration, finance companies can visualize customer trends, performance metrics, and engagement levels in real time. Instead of waiting for monthly reports, decision-makers can act on insights as they emerge.

Customer Behavior Tracking

Dynamics 365 CRM tracks how customers interact with the organization over time. This helps finance companies identify patterns such as frequent service requests, delayed responses, or increased engagement—signals that often indicate future needs or risks.

Predictive and AI-Driven Insights

Using AI capabilities, Dynamics 365 CRM can highlight trends and forecast outcomes based on historical data. While not replacing human judgment, these insights help teams prioritize leads, identify at-risk customers, and plan proactive engagement strategies.

Industry-Specific Use Cases for Finance Companies

In finance companies, customer insights are applied across multiple workflows. Loan and credit teams use CRM data to understand applicant behavior and processing timelines. Relationship managers rely on insights to personalize interactions and recommend suitable financial products.

Customer service teams benefit from a complete interaction history, enabling faster resolution and more personalized support. These use cases show how insights directly impact both efficiency and customer satisfaction.

Improving Decision-Making with Actionable Insights

When customer insights are accessible, accurate, and timely, finance companies can make smarter decisions at every level. Sales teams can prioritize high-quality opportunities, managers can optimize processes and resource allocation, and leadership can align business strategy with actual customer behavior and risk patterns. This data-driven approach reduces guesswork, improves efficiency, and supports better outcomes in highly regulated financial environments.

Dynamics 365 CRM turns insights into action by embedding analytics directly into everyday workflows, so teams can act on data in real time rather than relying on static reports. By combining analytics, automation, and governance, finance companies can improve decision-making while maintaining compliance and data integrity. Microsoft highlights the importance of integrated analytics for financial services decision-making here.

Ensuring Data Security and Compliance While Gaining Insights

Security and compliance are critical in financial services. Dynamics 365 CRM supports role-based access, audit trails, and secure data management practices. This allows finance companies to gain insights without compromising regulatory requirements or customer trust.

By maintaining data accuracy and controlled access, finance firms can confidently use customer insights for growth and optimization.

Benefits of Better Customer Insights for Finance Companies

Stronger customer insights enable finance companies to deliver more personalized and consistent customer experiences while making faster, more informed decisions. By understanding customer behavior, preferences, and risk signals, teams can anticipate needs, reduce operational inefficiencies, and improve retention through timely, relevant engagement across the customer lifecycle.

Over time, insight-driven processes help finance firms build customer trust, increase profitability, and stay competitive in an increasingly data-driven financial landscape. According to Microsoft, organizations that use data-driven insights effectively are better positioned to improve customer engagement and business outcomes:

Best Practices to Maximize Customer Insights Using Dynamics 365 CRM

To get the most value from Dynamics 365 CRM, finance companies should focus on clean data management, meaningful dashboard design, and continuous user adoption. Integrating CRM with Power Platform tools further enhances insight generation and automation.

Regular optimization ensures that insights remain relevant as business needs evolve.

Conclusion

Dynamics 365 CRM empowers finance companies to move beyond basic data collection and toward true data-driven intelligence. By delivering a unified, secure, and real-time view of customer information, it enables organizations to generate actionable insights that improve decision-making, personalize customer engagement, and manage risk more effectively. This insight-led approach helps finance teams respond faster to customer needs while maintaining compliance in a highly regulated environment.

However, realizing the full value of customer insights depends on how well Dynamics 365 CRM is implemented and optimized. With the right strategy, configuration, and ongoing refinement, finance companies can turn CRM insights into measurable business outcomes. At CRM Stuff, we specialize in helping finance organizations implement and optimize Dynamics 365 CRM to unlock deeper customer insights, improve operational efficiency, and drive long-term growth.

Frequently Asked Questions

How does Dynamics 365 CRM help finance companies gain customer insights?

Dynamics 365 CRM centralizes customer data, tracks interactions, and provides real-time analytics, enabling finance companies to understand customer behavior and make informed decisions.

Is Dynamics 365 CRM suitable for small and mid-sized finance companies?

Yes, Dynamics 365 CRM is scalable and can be customized to meet the needs of both small finance firms and large financial institutions.

Can Dynamics 365 CRM integrate with financial systems?

Dynamics 365 CRM integrates with ERP systems, Power BI, Outlook, and other Microsoft tools, allowing finance companies to combine operational and customer data.

How secure is Dynamics 365 CRM for financial services?

Dynamics 365 CRM includes enterprise-grade security features such as role-based access, audit logs, and data protection to support compliance requirements.